What outcomes should be included in our logic model or explored in our evaluation?

The outcomes identified in the logic model should be measurable and reasonably achievable with the available resources within the specified time period. The more specific the outcome — in terms of the participant and the intended change, the processes of program development, and the content delivery methods — the clearer evaluation and monitoring becomes. If the intended change is specific, the educator can focus educational activities and evaluation to facilitate and document that specific outcome. Lastly, evaluation outcomes should be strongly aligned with the content of the financial education program.

When selecting the most relevant and appropriate outcomes for the logic model, it’s useful to consider what is feasible given the intervention and when particular types of outcomes typically can be expected and observed.

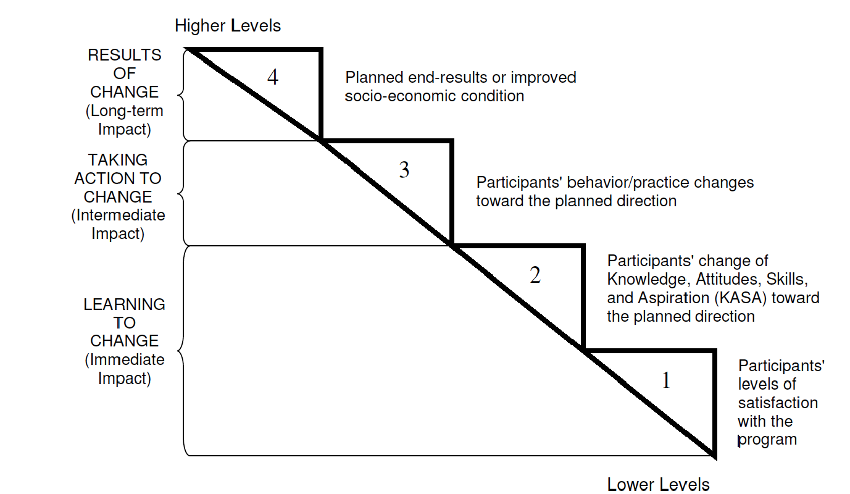

The Financial Education Outcomes Hierarchy below can be used to understand the program outcome process. Immediate or short-term outcomes include changes in participants' knowledge, attitudes and aspirations that can be measured soon after completion of the program.

Intermediate outcomes include changes in participants' financial behavior, such as the adoption of appropriate financial management practices. Normally, intermediate outcomes take one to six months to manifest. Long-term outcomes are improved economic conditions, such as paying down debt and buying a house. Generally, long-term outcomes take more than six months to manifest.

Financial Education Outcomes Hierarchy

The first measurable outcome of a program is how satisfied participants are with their experience. Depending on participants’ interaction with the program, the quality of the program, and how well it met their needs, participants may be satisfied, indifferent or dissatisfied.

The first measurable outcome of a program is how satisfied participants are with their experience. Depending on participants’ interaction with the program, the quality of the program, and how well it met their needs, participants may be satisfied, indifferent or dissatisfied.

If participants are satisfied with the program, then there is potential to elevate to the next level of outcomes: learning. Learning includes changing participants' knowledge, attitudes, skills and intentions to engage in the financial behaviors taught in the program. If the program is effective, these outcomes take place during or immediately after the program ends.

Another strong outcome is determining participants' perceptions of their own readiness to apply the financial behaviors that the educator wants them to practice and adopt at the end of the educational program. Generally, the objectives of financial education programs include guiding participants to adopt desired financial management behaviors or proactive financial practices. If the program is effective, participants will show their readiness to adopt these financial practices by planning to implement them. The potential degree of participants’ expected change varies with the educational program, type of participants, and the participants' socioeconomic environment. The participants' behavior change can take place over a period of time. If participants adopt appropriate financial management behaviors, there is a potential for achieving the next level of outcomes.

The lower the level on the outcome hierarchy, the easier it is to document, but the weaker the evidence to justify the educational program. The higher the level on the outcomes hierarchy, the stronger the evidence for the justification of the program, but the more difficult it is to document the results. In planning for the evaluation, the educator needs to balance the strength of the evidence needed to address the evaluation priorities and answer the evaluation questions while also considering what is practical and feasible for data collection.

Below are two sample programs, followed by potential short-term and long-term outcomes relevant to each program.

| Example Program |

Short-Term Outcomes |

Long-Term Outcomes |

|

First-Time Homebuyer Education Program

|

- Knowledge of how to assess affordable housing

- Knowledge of how to save money for closing costs

- Ability to shop for the lowest mortgage interest rate

- Reduced stress and anxiety about home buying process

|

- Application of knowledge during home-buying process

- Purchase of a home within financial means

- Successful payment of mortgage over time

|

|

Debt Reduction Education Program

|

- Ability to identify needs and wants separately

- Understanding of effective spending habits

- Knowledge of personal and household budgeting techniques

- Knowledge of credit building strategies

|

- Reduced debt

- Improved debt ratio (debt/assets)

- Improved credit score

- Frequent use of personal budget techniques to manage debt

|

The Consumer Financial Protection Bureau (CFPB; http://www.consumerfinance.gov/ ) has published a Developmental Model of Youth Financial Capability to inform the selection of appropriate outcomes for youth participants in financial education programs. The CFPB model suggests that financial education is built via three primary components that are most susceptible to change or growth during particular years of life. This means that the selection of outcomes for a financial education program serving youth and young adults should consider the age of the participants in selecting the program’s intended outcomes to be sensitive to the developmental potential of each age group.

The primary developmental goal for financial education programs targeting early childhood (ages 3-5) is the development of executive function (e.g., self-control, working memory and problem solving). In middle childhood (ages 6-12), children have a greater potential to develop healthy financial habits and norms, including frugality, the value of saving and planning ahead, and considering their own values when making spending decisions. In adolescence and young adulthood (ages 13-21), interventions should aim to develop financial knowledge and decision-making skills. For adult learners, the CFPB has resources to support the development of “financial well-being.

To learn more about financial well-being and this developmental model of financial capability, please visit the Consumer Financial Protection Bureau (CFPB) website.

CFPB Developmental Model of Youth Financial Capability

| |

Executive function

Self-control, working memory, problem solving

|

Financial habits and norms

Healthy money habits, norms, rules of thumb

|

Financial knowledge and decision making skills

Factual knowledge, research and analysis skills

|

| Early childhood (ages 3-5) |

|

Early values and norms |

Basic numeracy |

| Middle childhood (ages 6-12) |

Development continues |

|

Basic money management |

| Adolescence and young adulthood (ages 13-21) |

Development continues |

Development continues |

|